-

Getting The What Age Does Car Insurance Rates Go Down? (2022) To Work

Automobile insurance coverage does go down at 25. affordable auto insurance. The typical price of cars and truck insurance coverage for a 25-year-old is $3,207 for an annual policy. insured car.

Our evaluation found that prices go down far more at other 1 year intervals. Continue reading to read more information about when vehicle insurance coverage does go down. Supplied they preserve a clean document, young drivers will likely see their cars and truck insurance coverage go down after yearly driving on the road yet just how much it in fact reduces by varies from year to year.

vehicle insurance laws credit car

vehicle insurance laws credit carYour cars and truck insurance does go down after you turn 25, but not as high as it does on other birthdays. However, unless you stay in a state where insurers can't factor sex into insurance credit coverage rates, one considerable modification take place at age 25: the difference in between what man as well as female vehicle drivers pay for car insurance coverage. cheapest auto insurance.

cheap liability trucks business insurance

cheap liability trucks business insuranceOther factors can influence 25-year-old cars and truck insurance policy rates more significantly than sex. Here are a few of the reasons that your prices might not have gone done when you reached age 25: If you're a new driver at 25 years old (or over) and also it's your very first time purchasing cars and truck insurance policy, after that you'll pay much more than a vehicle driver who was licensed at 16.

Unless you reside in among the couple of states that have actually made it illegal, a lower credit report score may boost your car insurance costs. If you relocate to an area with greater prices of theft as well as vandalism, then insurance providers will charge you greater premiums to make up the raised danger of damage or burglary (insured car).

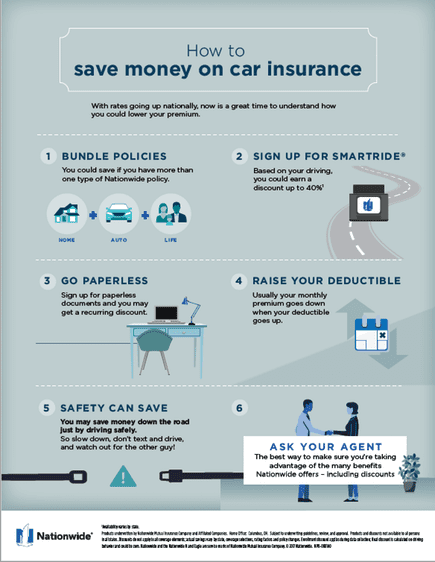

Every insurance policy company determines prices in different ways, as well as some insurance provider will certainly highlight various factors extra greatly than others. We suggest reassessing your insurer annually to obtain the very best price. If you're a young vehicle driver in your 20s, you've most likely asked yourself exactly how to reduce your auto insurance coverage expenses. The bright side is, motorists of this age can take benefit of a number of approaches as well as price cuts to make their auto insurance policy prices drop. auto.

The Greatest Guide To 4 Ways To Save On Car Insurance – Geico

There are various other ways for 25-year-olds to get their insurance policy rates to go down – vehicle. Bought a shiny brand-new sporting activities vehicle?

If your automobile is just worth a couple of thousand bucks, it doesn't make good sense to spend for high costs to cover an asset of limited worth. cheaper auto insurance. If you're wed and also each of you drives separate cars, you may be able to lower your automobile insurance settlement by, as insurance firms think about married couples a lot more financially stable and also risk-averse.

As you search for the finest price, make certain you're also asking insurance provider concerning all suitable price cuts. Twenty-five-year-old chauffeurs may not be able to make the most of student-away-from-home or good-student policies, however there are plenty of various other means these young chauffeurs can minimize vehicle insurance policy: You may not be able to get a good-student discount any longer, however your college may have partnered with an insurer to protect price cuts for alumni – auto insurance.

By taking a, you'll not just discover just how to drive even more securely, yet you can minimize your vehicle insurance coverage premium anywhere from 5% to 20%. Be encouraged, nevertheless, that some states and some insurance providers only extend this price cut to seniors or vehicle drivers under 25 (insurance affordable). Talk to your insurance coverage business to see if you qualify before you enroll in a course.

Does your automobile have specific safety and security attributes, such as anti-lock brakes or daytime running lights? You might obtain a vehicle discount rate as a result of it. Ask regarding these discount rates when you call insurer for a quote. You may be stunned at the cost savings you have the ability to create simply by asking inquiries. credit.

When you initially obtain your license as a teenager, there's a likelihood you're not paying for car insurance yourself, which is lucky, due to the fact that those first couple of years of being insured are a few of one of the most expensive of your whole life. Good points come to those who wait, and that's additionally true for the cost of car insurance coverage, which goes down when you grow older.

All About When Do Car Insurance Rates Go Down?

As well as while your credit rating, marital status, as well as education degree can assist insurance providers determine your degree of danger, age is among the most significant variables – cheaper car. Teen drivers have a tendency to trigger even more mishaps than older, more skilled chauffeurs, so insurer elevate your rates as a result of the high risk factor. insurers. However, there are points you can do to assist decrease your prices.

According to the Insurance Institute for Freeway Safety, 60 to 64 year olds have the lowest price of claims they're fairly good chauffeurs with a reduced accident price so their insurance policy premiums are reduced – liability. However claims rates begin increasing once more for 65 year olds, as well as fatal auto collision prices increase at 70, so those drivers commonly will have greater premiums. vehicle.

Ask your insurance coverage firm regarding: Great pupil price cuts, Great motorist discounts, Automobile safety discounts, Packing as well as policy renewal price cuts, Use based discounts, that track your driving with an application and honor savings for secure driving patterns Among the quickest means to save can be to purchase new auto insurance policy prices quote from different business – low cost.

insured car business insurance automobile insured car

insured car business insurance automobile insured carNonetheless vehicle insurance coverage prices can additionally go up at renewal, also if you're gone the whole policy term without any type of accidents or cases. cheap.

laws insurers vehicle insurance car insured

laws insurers vehicle insurance car insuredFrom 30 to 64, vehicle insurance policy premiums continuously decrease through the years, however, sadly, you will not get those significant decreases as you saw at 25. When chauffeurs strike 30, they've had great deals of experience when driving as well as age becomes much less of an aspect in determining auto insurance coverage premiums.

-

Buy New Car Insurance Policy Online Instantly – Coverfox.com Fundamentals Explained

insurance money cheap car vehicle insurance

insurance money cheap car vehicle insuranceYou can purchase either of the 2 sorts of car insurance plan, i. e. Third-party Obligation or Comprehensive Plan. The difference in these two kinds of policies is the level of protection offered. Acquiring a Comprehensive Vehicle insurance coverage is suggested as it supplies a wider insurance coverage. It consists of protection for Own Damage, i.

Plus, you can buy Attachments for more protection. This is the current market worth of your auto. To understand the approximate value, describe the following table: You need to pay some part of the claim amount as a Compulsory Deductible. You can additionally decide to pay Voluntary Deductible, The original source but this amount requires to be stated when you purchase the policy.

There you go! Refer to this ready-made checklist while buying insurance policy and also you will acquire the policy like a pro even though it is your very first time. Read: Online Bike Insurance – cheap insurance.

There you are, out car shopping on a warm Saturday early morning. Whether it's your first cars and truck or your 5th, you can not aid really feeling the bubbles of excitement as you stroll across the whole lot, coffee in hand, looking at all the different vehicles – cheapest car insurance. Naturally you know what you desire. Kind of.

Did you call your insurance representative to make certain you and your brand-new auto are covered as you drive off the lot? There are in fact quite a few aspects to take into consideration when you purchase a brand-new or previously owned automobile.

Buying A New Car? It Can Pay To Get Insurance Quotes First – An Overview

Did you understand that bundling your vehicle insurance with your could save you as much as 25% on the complete package cost? A fast call to us at Huff Insurance before you go out to purchase can offer you the running start you require to stay in control (cheaper car insurance). You have actually discovered the cars and truck that you like as well as you are resting down to do the documentation.

No! It's Saturday mid-day, you are worn down as well as tired and you just intend to drive it home. Along comes your car supplier with some wonderful news: "You have 30 days to include it to your insurance policy strategy," he says. There's no requirement to fret? However, that's not quite true. money.

There are undoubtedly circumstances when you have thirty days to include the new car to your plan – cheap auto insurance. But there are much a lot of variables to give a basic policy discussing when the 30-day padding uses and also when it does not. It may work when you trade a vehicle yet it won't be appropriate when you get an additional vehicle.

They could obtain a lot extra for this if they desired to Wait. With all of the flooding occasions that have happened over the past couple of years (Storm Irene, Nashville Flooding, Superstorm Sandy, etc) there are thousands of cars being put on the market that have actually been previously swamped out.

So, down memory lane you go, Keeping in mind just how you drove the old beat-up blue pick-up vehicle to school (Pick-up? They must have named it Hick-up!) and were fantasizing concerning that sleek exchangeable Currently your son's 16, as well as you desire nothing more than make his dreams come true. What parent does not? Considering that both of you enjoy autos, you settle on a flashy design. cheapest auto insurance.

Unknown Facts About How To Insure A New Car? – Carinsurance.com

cheap auto insurance auto vehicle insurance car insurance

cheap auto insurance auto vehicle insurance car insurance cheap auto insurance insurance companies insurance cheap insurance

cheap auto insurance insurance companies insurance cheap insuranceThe shock comes Monday when you call your agent to add the new car to your insurance coverage strategy. Youthful motorists in mix with brand-new, sporty automobiles make for a pricey mix when it comes to your vehicle insurance policy.

money cheap auto insurance cars accident

money cheap auto insurance cars accidentOlder cars are usually less costly to guarantee because they are more economical to fix. And also keep in mind, you can always offer Huff Insurance policy a call for even more suggestions or sample rate quotes! Your grown-up child, who's been residing on her own for a number of years, was simply laid off from her work as a result of ever-present spending plan cuts.

Thankfully, she has actually interviewed for a brand-new placement as well as points are looking rather goodbut if she gets the task, she will certainly need a car to get herself there on a daily basis. Without a car, she can't take the work (cheaper cars). And also with the brand-new work, adding a vehicle repayment to the budget plan will certainly make things tightvery tight.

When purchasing and also financing a brand-new or previously owned car for your grown-up kid, believe twice: If you co-sign on a lending for a cars and truck that your boy or child will be driving, you might be held responsible if a crash happens also if you weren't driving, as well as also if the car was not noted on your insurance policy. low-cost auto insurance.

If your child is still a dependent, lives in your household, and/or is continuing his or her education, households will certainly usually discover the widest coverage and ideal insurance coverage rates by maintaining registration and insurance policy in the moms and dads' names (money). Acquiring a brand-new vehicle is very interesting! Obtain cruising right by giving our group at Huff Insurance a call before you go out to the dealership. insurance.

See This Report about Do I Add A New Car To My Insurance Before Buying, Or Can I Do …

One quick phone telephone call a lot less headache. We're right here to assist!.

Something went wrong. Wait a moment and try once again Attempt once again. vehicle.

Image source: Getty Images When purchasing a brand-new automobile, there are a whole lot of things to take into consideration. You desire to make certain the vehicle has enough seating for your family members, that it gets great gas mileage, as well as that it's budget-friendly.

-

Rumored Buzz on Does Insurance Cover A Crashed Car And Will My Rates Go …

car insured insurance cars cheapest

car insured insurance cars cheapest insurance affordable suvs perks automobile

insurance affordable suvs perks automobile vehicle cheapest car affordable car insurance cheapest car

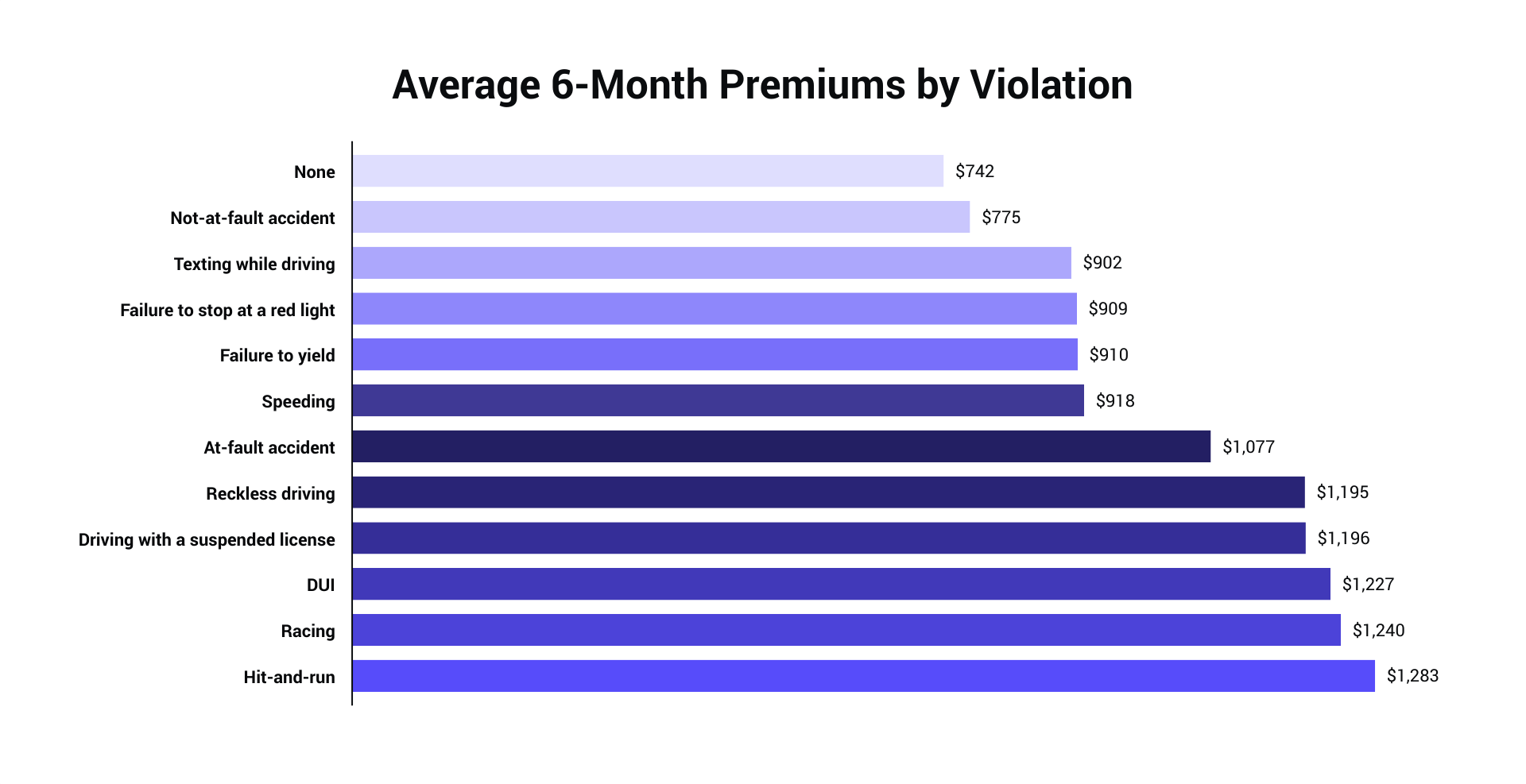

vehicle cheapest car affordable car insurance cheapest carSecured with SHA-256 Security Lots of people make the blunder of believing that their insurance coverage goes up after an accident because they obtain a ticket or are at fault in the mishap. auto insurance. If you remain in a single-car mishap and you damage your fender, after that you don't even require to make an car insurance claim.

If you make an insurance claim, also if the insurance policy company does not need to pay you any type of money, you might see a boost in your vehicle insurance coverage premiums. The boost needs to be small if the insurance coverage business does not have to compose a check however anticipate a boost nevertheless (car insurance). When you report you have had a mishap, it goes on your document and counts against you in terms of being a risk-free motorist.

Firstly, if you hit a property fencing, mailbox, or perhaps a tree in somebody's lawn, you need to speak with the proprietor about making restitution. If you struck a deer or other pets, you do not have to call the authorities and report the crash, also if there are problems to your vehicle (cars).

If you strike a roadway sign, you will be anticipated to make restitution. The fact is that the cops aren't most likely to be damaging down your door in an effort to get cash for the damages that you create to an indication. Nonetheless, if you are captured without having reported the incident, after that you could be in much deeper trouble than simply striking an indicator would certainly trigger.

Fortunately is that the smaller the insurance claim is the much less your costs will be enhanced. If you really did not obtain a ticket for the accident, after that you may want to take into consideration switching cars and truck Great post to read insurance provider. If an insurer really did not need to pay your insurance claim, they are more probable to give you a reduced price faster than the business that had to pay the cost for the crash.

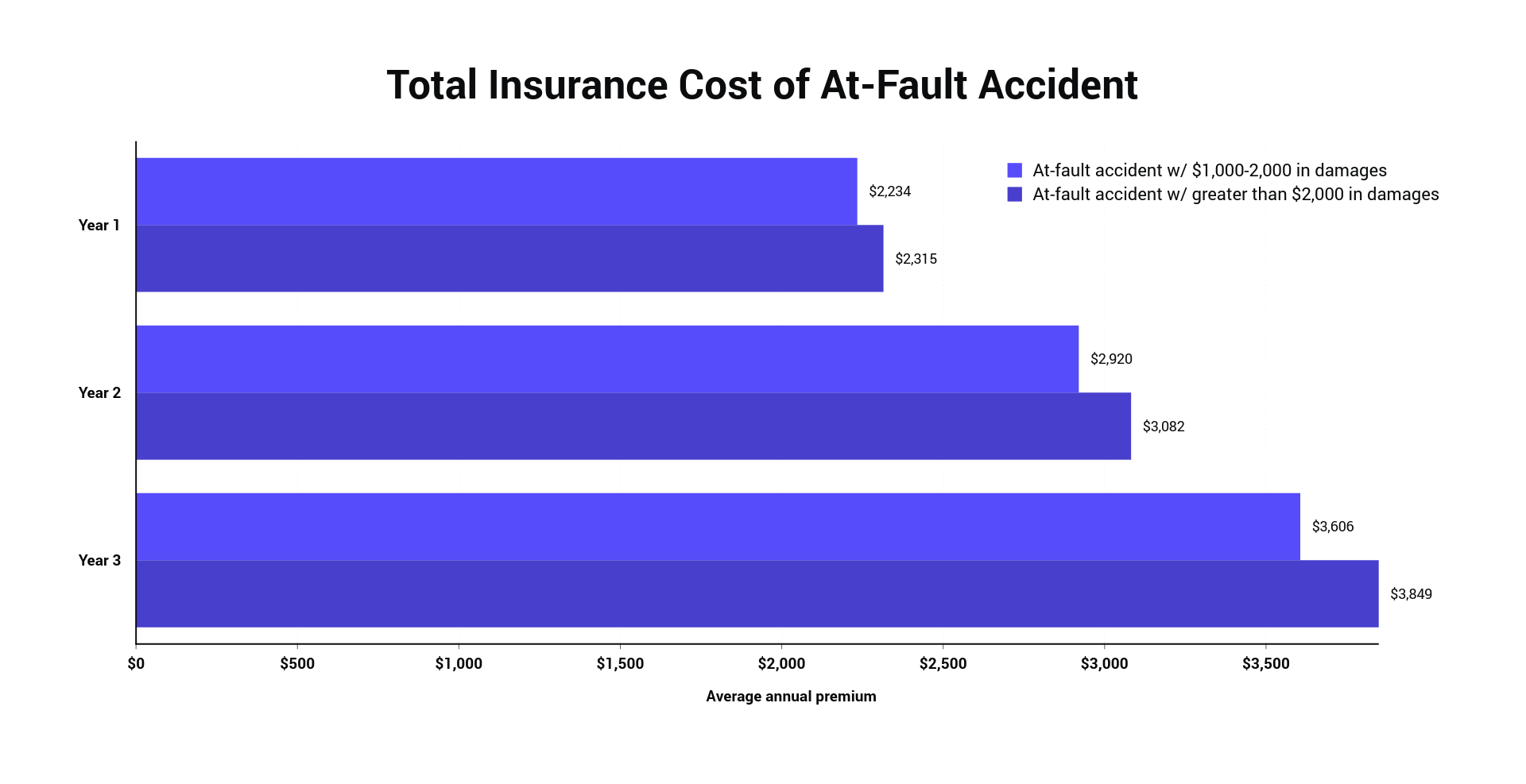

The amount differs depending on who is to criticize for the claim, the intensity and cost of the accident, and also your total driving document. The insurance claims with the biggest influence on your future premiums at at-fault claims. These are mishaps you are accountable for and also which cause damages to your automobile as well as the cars and building of other individuals. credit score.

Indicators on How Much Does Insurance Go Up After An Accident For A … You Should Know

Your costs will climb even if you're the blameless target of a crash or burglary. This hardly appears reasonable, however insurance providers have located from their data that vehicle drivers who make non-fault cases are most likely to assert once more in the future. A non-fault case may not recommend you're a bad motorist yet might indicate you're on the road at times and in position where mishaps are more probable, such as active junctions at rush hour, or that you're auto parking your vehicle somewhere it's much more most likely to be struck or stolen.

This may happen if your automobile is struck by a vehicle driver that speeds up off and can't be traced or by a chauffeur without insurance – suvs. Part of the increase in your costs complying with an insurance claim will be from the loss of your no-claims discount. These are price cuts you accumulate over years of claims-free driving.

This security will certainly add about 60 to your yearly insurance policy premiums so you'll need to weigh just how much you stand to lose from losing your no-claims discount (affordable car insurance).

If you have actually remained in a car crash in the state of Georgia, below are some things you require to learn about insurance, including just how your insurance coverage prices may or might not change: First, it is very important to note that the state of Georgia requires all drivers to lug responsibility auto insurance coverage (automobile).

Various other sorts of insurance protection are supplied in the state, yet are not compulsory (prices). These include coverage to pay for injuries and also damages triggered by uninsured as well as underinsured drivers, collision protection and medical settlements coverage. Lots of people ask yourself whether they have to report an auto mishap to their insurer.

The regulation is discovered in Area 40-6-273 of Georgia Code. If you are reporting the mishap to the cops, after that it is serious enough that you ought to report it to your insurance policy firm also. Falling short to report a crash to your insurance business can have negative results at a later date – insurance.

Everything about Will My Insurance Rates Go Up If I Get In A Car Accident?

It is much from fool-proof. Vehicle drivers that are ticketed by a law enforcement officer are not always located to be responsible in a civil court. A civil court makes an independent determination of mistake based on the evidence offered. If you have actually been injured in an Atlanta car crash or/and have been blamed for triggering an accident, you need to consult with an Atlanta automobile mishap attorney asap.

Many chauffeurs fret that if a crash takes place, it will enhance their insurance prices – credit. While this can take place, particularly if you were at mistake, it is not constantly the situation. Even if the police report specifies that you were at fault for the mishap, and also the insurer agree, you might still be able to keep your insurance prices reduced.

Simply put, if you submit a civil activity complying with a mishap, the court's independent verdict will shield you from an insurance rate boost. – D. cheapest. Lo I would very suggest this company as well as personnel to everybody, they were excellent with my case – car insurance.

insurance companies credit vehicle insurance prices

insurance companies credit vehicle insurance pricesAnd they had actually been long-time clients given that the insurance coverage company initially opened up. Assuming she could get some alleviation due to their loyalty, she made an instance to have her premium reduced. The insurance firm would not budge.

The exact same study did discover that For car crashes that aren't your mistake, this can potentially make your automobile insurance policy go up. Some states, like California and also Oklahoma, have regulations that restrict insurer from penalizing faultless motorists. It's not the very same across the nation. Also suing for a no-fault accident can lead to premium walks.

-

The Buzz on Buying Weekly Car Insurance – Carinsurancecomparison.com

To learn if you have this stipulation, call your agent or refer to your car insurance coverage policy web page. It will inform you the level of the protection as well as how much time you have before it ends (insured car). While convenient, this choice can be risky as numerous dealerships and also also some regulation enforcement firms aren't knowledgeable about it.

This is particularly true if the dealer is financing you, as many financial institutions and also lending institutions require evidence of insurance policy prior to you can leave with the automobile. cheaper car insurance. Also if your supplier does consider this sufficient proof and does allow you off the lot, you ought to still reserve a consultation with your insurance agent as quickly as possible to officially include the brand-new vehicle. cheaper.

If you have currently selected one specific auto, give your representative the details and also have it guaranteed before you go pick it up. According to Vehicle Inspect, you need to establish a day prior to you officially acquire the automobile. Obtain the VIN number and purchase cost so you can make a computed decision.

cheaper auto insurance affordable car insurance car affordable auto insurance

cheaper auto insurance affordable car insurance car affordable auto insuranceIt's reasonably simple for seasoned chauffeurs with existing vehicle insurance plan to guarantee their new car (insurance). Sometimes, you can also repel the great deal prior to the brand-new cars and truck is included in the plan, but it is a still good idea for brand-new drivers to always have insurance coverage prior to buying an auto.

Use a rate comparison site to see what insurance coverage firms in your ZIP code are charging for different types of autos – insurance. Automobile insurance coverage is particularly expensive for new vehicle drivers.

The 15-Second Trick For Buying A Car: How Do You Add Insurance If You Buy Over The …

Ask your salesman if they will permit you to access the net and also buy insurance policy prior to you get your car (cheaper car insurance). If so, it's Click to find out more possible that you can register for a plan right then and there and also get your agent to fax evidence of insurance policy to the car dealership promptly so you can drive off.

It is unlawful for you to drive an auto without being correctly insured according to your state's laws and policies. There are some things that you can do to make certain that acquiring insurance for your initial car is less of a migraine. vehicle insurance. When you are checking out cars and trucks, make certain you select 2 or even more that you like (cheap car).

cheapest auto insurance low cost auto cheaper cars

cheapest auto insurance low cost auto cheaper carsWhen it concerns insurance policy prices, no auto will have the same cost. Keep in mind that a more pricey auto will certainly set you back more to insure. There are numerous kinds of optional insurance plan that brand-new cars and truck individuals can purchase to protect themselves from financial losses in case of a mishap.

vehicle insurance company credit score cheapest

vehicle insurance company credit score cheapestThis means that if a crash happens the insurance coverage business could just pay for the cars and truck's current worth, rather than its initial value when you bought it. insured car. If your car has actually undoubtedly decreased in worth, you would be compelled to pay for the remainder of the problems expense in case of an accident.

If you deal with a relative, you can attempt to jump on their insurance policy. Depending on the auto insurance policy company, you can get a discount rate for packing your car with their own – cheapest car insurance. You will also take advantage of their insurance coverage history and experience, so this will certainly cause a lower settlement for you.

Some Known Details About How To Buy Car Insurance For The First Time? – Its Overflowing

You have to have car insurance to drive as well as there is no chance around it. These driving regulations remain in location to protect you and also everybody else around you. Wondering why you require vehicle insurance coverage? Driving without insurance policy influences every person around you. According to state legislatures, you position a significant risk to motorists and also pedestrians when you do not follow the regulation and also lug automobile insurance – cheap insurance.

If you're not paying insurance policy, someone still has to pay. These premiums climb commonly, as well as generally these accountable drivers are not as well pleased to have to pay for someone else who is not cracking in.

You are likewise still called for to bring comprehensive and also accident protection. There are in some cases exemptions to this when an auto is 10 years or older.

It is still best to look at all alternatives with your insurance representative to see which insurance coverages may be most proper for you as well as your lorry. The lower line: You can't prevent having vehicle insurance when getting a vehicle – auto. Regardless of just how you pay for your automobile, it's generally best to deal with the insurance coverage initially.

It is very important for vehicle drivers to understand the various kinds of protection offered to them – auto. Being educated concerning coverage kinds will certainly help chauffeurs make the most effective decisions concerning their budget and their cars and truck insurance policy. If you are intending to keep an auto without insurance coverage, this details is additionally important to understand – cheapest car insurance.

Excitement About Buying A Car: How Do You Add Insurance If You Buy Over The …

Bodily injury liability covers clinical costs and also funeral service expenses associated with injuries you have actually created. Motorists should recognize that obligation protection only pays for problems they create to other individuals; it does not cover problems that they sustain in a mishap. Even though insurance policy coverage is called for by regulation in many states, some vehicle drivers still pick to ignore the regulation.

accident low cost auto cheapest car insurance cheaper cars

accident low cost auto cheapest car insurance cheaper carsIf you have underinsured vehicle driver protection, your plan will pick up the prices where the other driver's coverage leaves off. insured car. Your medical costs from a mishap can be covered by med pay, likewise referred to as PIP protection. Additionally, shed incomes and paying for necessarily hired assistance around the house for cooking, cleaning, or child care can potentially be covered under med pay. affordable auto insurance.

-

The Teenager Car Insurance Ideas

Having the ability to look at both kinds of quotes alongside will provide you an excellent review of coverage offerings and cost, and also assist you obtain your best auto insurance policy. Compare quotes to discover inexpensive prices. insurance affordable. There are several discount rates offered to 19-year-old vehicle drivers that can assist reduce your car insurance policy costs.

Power compiles a yearly client complete satisfaction survey that suggests how well a vehicle insurance company satisfies consumer assumptions, based upon a range of zero to 1,000. The table below programs the typical expense of auto insurance coverage from 11 significant service providers, together with their J.D. Power rankings. Ordinary monthly price and also consumer fulfillment ranking by business Business Typical price for 19-year-old chauffeur J – credit.D.

Your rates may differ. It ought to be kept in mind that while USAA has one of the much better combinations of reduced premium expense and client contentment, it just gives automobile insurance coverage to active army participants, professionals and their households. If you have actually employed in a branch of the Armed Forces, take into consideration getting a quote from USAA – cheapest car.

As young vehicle drivers obtain out on the roadway and also experience is gained, insurance premiums will certainly lower. It is no secret that auto insurance policy in New York is a lot more costly than in various other states.

For a 19-year-old lady, on standard, it is $5,462 a year. For a 19-year-old male, it is an average of $6,458 a year (money). New York is the second more costly state for guaranteeing 19-year-old.

Cost Of Car Insurance For 19-year-olds In 2022 – Quotewizard Things To Know Before You Get This

Picking the best vehicle and also the insurer will certainly impact your costs as well as discount rates offered by the insurance provider. low cost. It is not unusual for a 19-year-old to wish to drive the fastest sporting activities vehicle or largest truck on the whole lot, but that will only hurt your insurance coverage costs (money).

Selecting the appropriate lorry can affect your insurance premium, so be sure to shop around prior to resolving on the newest cars and truck on the great deal. Shopping around for the right insurance coverage firm is just as crucial as shopping about for the best vehicle (credit).

Not numerous 19-year-olds have a considerable credit scores background to aid reduce insurance coverage prices to reveal you are economically responsible. There are ways to build your debt, which will aid reduced insurance prices.

These price cuts are additionally offered to 19-year-old chauffeurs. Insurance policy business see high qualities as proof of responsibility.

As young chauffeurs obtain out on the road and also experience is gained, insurance policy premiums will certainly reduce. It is no secret that car insurance policy in New York is much more expensive than in other states.

Excitement About Eligibility For Health Care Benefits For Masshealth … – Mass.gov

cheapest car insurance cheapest auto insurance auto affordable auto insurance

cheapest car insurance cheapest auto insurance auto affordable auto insurance car insurance vans money low cost

car insurance vans money low costFor a 19-year-old lady, on average, it is $5,462 a year. For a 19-year-old man, it is approximately $6,458 a year. New york city is the 2nd extra expensive state for guaranteeing 19-year-old. Michigan is the most expensive. As a no-fault state, New york city vehicle drivers often succumb to insurance scams, which raises premiums.

Selecting the ideal cars and truck and also the insurer will certainly influence your costs in addition to discounts provided by the insurance coverage business. It is not unusual for a 19-year-old to intend to drive the fastest cars or largest vehicle on the lot, however that will only injure your insurance policy premiums.

Choosing the best vehicle can influence your insurance costs, so be certain to go shopping around before settling on the most recent vehicle on the great deal. Buying around for the right insurance company is simply as essential as going shopping around for the best automobile – vans.

Not lots of 19-year-olds have a considerable credit report history to assist lower insurance coverage prices to reveal you are monetarily accountable (cars). There are means to develop your credit, which will help lower insurance coverage prices.

These price cuts are additionally given to 19-year-old vehicle drivers – car. As a 19-year-old Have a peek at this website motorist, you have the opportunity to receive a discount rate if you obtain good grades. The majority of the time, this discount needs pupils to have a B standard at an university, college, or profession school. Insurer see high qualities as proof of duty.

Top Guidelines Of How Much Does Your Car Insurance Increase When You Add …

19-year-old motorists see rates at practically double that quantity. This is a rate drop from an 18-year-old, nonetheless. As young drivers go out when traveling and experience is acquired, insurance policy costs will certainly lower. affordable car insurance. It is clear that vehicle insurance policy in New york city is much more expensive than in various other states.

For a 19-year-old woman, usually, it is $5,462 a year. For a 19-year-old male, it is approximately $6,458 a year. New york city is the 2nd a lot more pricey state for insuring 19-year-old. Michigan is one of the most expensive. As a no-fault state, New York chauffeurs typically come down with insurance coverage scams, which enhances costs (perks).

Choosing the best automobile and also the insurer will affect your costs as well as price cuts supplied by the insurance provider. It is not uncommon for a 19-year-old to intend to drive the fastest cars or largest vehicle on the whole lot, but that will only harm your insurance policy costs. insurance.

Picking the best automobile can affect your insurance premium, so be certain to go shopping around before settling on the most recent auto on the whole lot. Shopping around for the appropriate insurance business is simply as vital as shopping around for the appropriate car. insurance companies.

affordable auto insurance prices cheaper car car

affordable auto insurance prices cheaper car car low-cost auto insurance vehicle insurance affordable car insurance

low-cost auto insurance vehicle insurance affordable car insuranceSome of the most effective insurance provider for 19-year-old motorists consist of Erie Insurance, USAA, GEICO, AAA, Travelers, as well as Progressive. Very few 19-year-olds have a considerable credit report to assist decrease insurance rates to show you are economically accountable. However, there are methods to develop your credit rating, which will aid reduced insurance rates.

How Average Car Insurance Cost For 19-year-olds can Save You Time, Stress, and Money.

These price cuts are also given to 19-year-old chauffeurs – car insurance. As a 19-year-old driver, you have the chance to obtain a price cut if you receive great grades. A lot of the time, this discount rate requires students to have a B standard at an university, university, or trade institution. Insurer see high qualities as evidence of duty.

-

You Really Can Lower Your Car Insurance Cost – The New … for Dummies

Numerous insurance providers give discounts for paying simultaneously, plus your regular monthly payments could be subject to on the internet costs, boosting your bill. The state you reside in establishes just how much insurance policy coverage you're needed to purchase. Likewise, residing in high-traffic areas as well as locations with high crime rates can trigger your insurance policy sets you back to rise.

Having no or negative credit history can lead to a higher annual premium – auto. Automobiles might be thought about greater threats if they cost even more to fix or are extra most likely to be stolen – affordable. You'll additionally typically see a greater price if you own something like a luxury auto, as the insurance provider will have to pay even more cash if it's harmed.

More youthful drivers are great candidates for this, as a student might find a Browse around this site far better price by being on a moms and dad's plan. Ask an insurance coverage representative what price cuts you get approved for when it's time to restore your car insurance coverage – insurance. Altering your deductible is another way to a lower costs. Your deductible is the out-of-pocket expenditure you pay prior to your insurance policy pays throughout the claims process. vans.

If you're a veteran of the USA army or have a relative with an existing USAA account, USAA is an excellent choice for insurance policy protection – trucks. Customers can save 15 percent on their policies if they have an army background, 10 percent for packing policies, and also added financial savings for remaining with the business for a number of years.

Some Known Questions About Is Insurance More Expensive For Leased Cars? – Wawanesa ….

Methodology In an initiative to give exact and also unbiased information to customers, our expert review team collects information from lots of automobile insurance companies to create positions of the very best insurance providers. Companies receive a score in each of the following categories, in addition to an overall weighted rub out of 5. business insurance.

The amount you'll pay for car insurance coverage is influenced by a number of very different factorsfrom the type of insurance coverage you have to your driving document to where you park your cars and truck. You may likewise pay even more if you're a new motorist without an insurance policy track record. The even more miles you drive, the even more chance for mishaps so you'll pay more if you drive your car for job, or utilize it to commute long distances.

Insurance firms typically bill much more if teens or young individuals below age 25 drive your cars and truck. Statistically, ladies tend to enter into less accidents, have less driver-under-the-influence mishaps (Drunk drivings) andmost importantlyhave less severe mishaps than males. So all various other points being equivalent, females typically pay much less for auto insurance policy than their male counterparts.

The Ultimate Guide To How To Reduce The Cost Of Commercial Auto Insurance

, as well as the kinds as well as quantities of policy alternatives (such as crash) that are prudent for you to have all influence exactly how much you'll pay for coverage – credit score.

The typical vehicle driver in the united state pays $1,424 annually for a complete protection plan with 100/300/100 restrictions. However, the expense of automobile insurance in New York is a lot higher there, the average driver spends $3,433 every year for protection. The state is equaled only by Michigan for the most costly insurance premiums in the country.

2% increase in costs over the past 6 years. Aspects such as high healthcare costs and extra insurance policy needs contribute to why cars and truck insurance coverage is so costly in New york city. Since of this, Money, Nerd recommends that vehicle drivers compare quotes as well as search to locate economical auto insurance in New york city.

insurance company business insurance insurance affordable low cost auto

insurance company business insurance insurance affordable low cost autoNew York automobile insurance coverage rates have raised 14. Compared to other states, New York has a lot more insurance policy requirements, such as wrongful death protection, individual injury defense and uninsured vehicle driver coverage.

Examine This Report on How A Lapse In Coverage Affects How Much You Pay For Auto …

liability car affordable auto insurance risks

liability car affordable auto insurance risksThese added insurance coverages increase the general price of insurance coverage for motorists in the state (cheap insurance). Automobile Insurance Price Increases in New York, The typical cost of vehicle insurance coverage in New York is $3,433 per year or about $286 per month. Vehicle insurance prices in New York have actually enhanced in recent years.

In a year when most states saw rate decreases, the price of car insurance coverage in Louisiana bumped up 19%. dui. In Louisiana, uninsured and also underinsured motorists integrated with very easy suits are the significant variables in pressing up rates.

low-cost auto insurance affordable car insurance cheapest auto insurance affordable auto insurance

low-cost auto insurance affordable car insurance cheapest auto insurance affordable auto insuranceDrivers with little to no insurance coverage obtain into mishaps as well as after that file a claim against each various other in front of chosen judges that are more than satisfied to side with drivers over insurance coverage companies; the big loser is car insurance coverage prices. This lawful situation can lead to big accident settlements and also insurance firms pass those prices onto all drivers using higher costs.

Why Is Car Insurance So High In Florida? Let's Count The Reasons. Fundamentals Explained

The legislation used to permit a plaintiff to recuperate the complete amount billed and also neglect any kind of discount bargained by an insurance firm. For the most part, there is a significant distinction in between the quantity a medical facility charges as well as what an insurance business in fact pays for medical expenses because of worked out price cuts.

"It may take a couple of years for prices to come down with present insurance companies as they see claim negotiation amounts lowered. Regardless of current changes, vehicle insurance is still pricey This is the first time in eight years that Michigan has not been at the top of the list, and its action to second place is based on a triviality. auto.

" We did see virtually a 30% reduction in prices for transforming from limitless PIP to a cap of $250,000, yet I would certainly hope by next year to see the prices drop much more as the financial savings go up (risks)." Older drivers, lots of universities, and lots of uninsured chauffeurs Florida remained in 3rd area for the fifth year in a row.

A very current adjustment to cars and truck insurance regulations influence future prices, however some fret it might push some prices even higher. insurers. Without insurance vehicle drivers have actually always been a concern in Florida. According to the III, about 20. 4% of drivers in Florida are out when traveling without coverage which is among the highest possible rates in the country. accident.

-

Travel Insurance – Affordable Plans Starting At $23 – Allianz … – Questions

-

All About What Determines The Price Of An Auto Insurance Policy? – Iii

low-cost auto insurance money perks low cost auto

low-cost auto insurance money perks low cost autoYour state's automobile division website should explain its needs and also might offer other guidance certain to your state. suvs.

The rate information originates from the AAA Structure for Traffic Safety, and it makes up any type of crash that was reported to the police. The ordinary costs data originates from the Zebra's State of Automobile Insurance record. The prices are for policies with 50/100/50 obligation protection limits and also a $500 deductible for comprehensive and crash coverage.

According to the National Freeway Web Traffic Security Administration, 85-year-old males are 40 percent more probable to enter into an accident than 75-year-old males. laws. Looking at the table above, you can see that there is a direct correlation in between the crash price for an age as well as that age's ordinary insurance policy premium.

Remember, you may discover better rates with an additional firm that doesn't have a certain pupil or elderly discount. * The Hartford is just offered to participants of the American Organization of Retired Persons (AARP). Nonetheless, policyholders can include younger motorists to their policy and also get discounts. Ordinary Auto Insurance Coverage Rates As Well As Cheapest Service Provider In Each State Since auto insurance coverage prices differ a lot from state to state, the supplier that supplies the cheapest vehicle insurance coverage in one state might not use the most affordable coverage in your state.

You'll also see the ordinary expense of insurance policy because state to help you compare – suvs. The table additionally consists of rates for Washington, D.C. These rate approximates apply to 35-year-old motorists with great driving documents and credit. As you can see, average vehicle insurance coverage expenses differ widely by state. Idahoans pay the least for car insurance, while motorists in Michigan fork over the big dollars for coverage.

How Much Car Insurance Do You Need? – Wsj Things To Know Before You Buy

If you stay in midtown Des Moines, your premium will most likely be greater than the state standard (cars). On the other hand, if you reside in upstate New york city, your cars and truck insurance policy will likely cost less than the state average. Within states, cars and truck insurance policy premiums can vary extensively city by city.

The state isn't one of the most pricey general. Minimum Protection Needs A lot of states have economic duty laws that need motorists to lug minimum cars and truck insurance policy coverage. You can just bypass coverage in two states Virginia and New Hampshire however you are still economically in charge of the damages that you trigger.

The price information originates from the AAA Foundation for Traffic Safety And Security, as well as it represents any crash that was reported to the cops. The average costs data comes from the Zebra's State of Auto Insurance policy report. The prices are for policies with 50/100/50 responsibility coverage limitations and a $500 deductible for thorough and also accident coverage – credit.

According to the National Freeway Website Traffic Safety And Security Administration, 85-year-old men are 40 percent most likely to obtain right into an accident than 75-year-old males. low cost auto. Checking out the table above, you can see that there is a direct relationship in between the accident price for an age which age team's typical insurance premium.

Remember, you may find better rates through one more company that doesn't have a certain trainee or elderly discount. * The Hartford is only offered to participants of the American Association of Retired People (AARP). Insurance policy holders can add younger drivers to their policy as well as get discounts. Typical Vehicle Insurance Rates And Also Cheapest Carrier In Each State Because vehicle insurance coverage prices differ so much from state to state, the carrier that supplies the most affordable cars and truck insurance policy in one state may not use the most inexpensive coverage in your state.

Some Known Incorrect Statements About How To Avoid Overpaying For Car Insurance – Yahoo News

You'll likewise see the ordinary cost of insurance policy in that state to aid you compare. The table additionally includes rates for Washington, D.C. These rate estimates use to 35-year-old chauffeurs with great driving records and credit scores. As you can see, average automobile insurance policy expenses differ commonly by state. Idahoans pay the least for car insurance coverage, while motorists in Michigan fork over the big dollars for protection.

If you stay in downtown Des Moines, your premium will most likely be greater than the state average. On the various other hand, if you live in upstate New York, your automobile insurance coverage will likely cost less than the state standard. Within states, car insurance premiums can differ extensively city by city (vans).

cheapest credit cheaper car insurance insured car

cheapest credit cheaper car insurance insured carThe state isn't one of the most expensive overall. Minimum Coverage Demands Many states have economic responsibility legislations that call for motorists to carry minimal automobile insurance policy coverage. You can just bypass insurance coverage in two states Virginia and New Hampshire however you are still monetarily in charge of the damage that you cause.

The price information originates from the AAA Foundation for Traffic Security, and also it makes up any crash that was reported to the cops. The typical premium information comes from the Zebra's State of Auto Insurance policy report (cheap car). The prices are for plans with 50/100/50 responsibility coverage restrictions as well as a $500 deductible for comprehensive as well as crash protection.

According to the National Freeway Traffic Safety Administration, 85-year-old males are 40 percent most likely to get involved in a mishap than 75-year-old guys. Taking a look at the table above, you can see that there is a straight relationship between the collision rate for an age as well as that age's typical insurance costs.

A Biased View of How Much Is Car Insurance? – The Balance

Insurance policy holders can include younger motorists to their plan and also obtain discount rates. Typical Car Insurance Policy Rates And Cheapest Company In Each State Due to the fact that vehicle insurance coverage prices differ so a lot from state to state, the provider that uses the most inexpensive car insurance coverage in one state might not provide the most inexpensive coverage in your state.

As you can see, average automobile insurance costs vary commonly by state. Idahoans pay the least for vehicle insurance policy, while motorists in Michigan shell out the huge bucks for coverage (insure).

If you reside in downtown Des Moines, your premium will possibly be even more than the state standard – risks. On the various other hand, if you reside in upstate New York, your automobile insurance plan will likely set you back less than the state standard. Within states, car insurance premiums can differ commonly city by city.

The state isn't one of the most pricey total. Minimum Insurance coverage Needs The majority of states have financial duty regulations that need drivers to bring minimum vehicle insurance policy coverage. You can just bypass insurance coverage in 2 states Virginia and New Hampshire yet you are still economically in charge of the damages that you cause (auto insurance).

vans affordable auto insurance money insurance

vans affordable auto insurance money insuranceThe price information comes from the AAA Structure for Traffic Security, as well as it represents any kind of accident that was reported to the cops. The average costs data originates from the Zebra's State of Auto Insurance report. cheap. The prices are for plans with 50/100/50 obligation protection restrictions and a $500 insurance deductible for thorough and accident coverage.

Facts About Average Cost Of Car Insurance In June 2022 – Nerdwallet Revealed

insurance auto insurance car insurance cheaper car insurance

insurance auto insurance car insurance cheaper car insuranceAccording to the National Freeway Web Traffic Safety Management, 85-year-old guys are 40 percent more probable to enter into a crash than 75-year-old men (insurance company). Taking a look at the table above, you can see that there is a direct connection between the crash rate for an age group and also that age's average insurance policy costs.

Bear in mind, you may discover better prices via another company that doesn't have a particular student or senior discount. * The Hartford is only readily available to members of the American Association of Retired Folks (AARP). However, policyholders can add younger vehicle drivers to their plan and get discount rates. Typical Cars And Truck Insurance Coverage Rates And Also Cheapest Company In Each State Due to the fact that vehicle coverage rates differ so a lot from state to state, the company that provides the least expensive cars and truck insurance policy in one state might not supply the least expensive insurance coverage in your state.

As you can see, average auto insurance prices vary extensively by state. Idahoans pay the least for automobile insurance coverage, while vehicle drivers in Michigan shell out the big dollars for coverage.

If you reside in midtown Des Moines, your premium will probably be greater than the state average. On the various other hand, if you live in upstate New York, your cars and truck insurance coverage policy will likely cost much less than the state standard – auto. Within states, vehicle insurance coverage premiums can differ extensively city by city.

However, the state isn't one of one of the most expensive general. Minimum Protection Demands The majority of states have monetary duty legislations that need motorists to lug minimum car insurance policy protection. You can only do away with insurance coverage in 2 states Virginia and New Hampshire however you are still financially responsible for the damages that you create.

6 Simple Techniques For Shopping For Auto Insurance: What To Know Before You Buy A …

The rate information originates from the AAA Foundation for Web Traffic Safety And Security, as well as it accounts for any kind of crash that was reported to the authorities. The average costs data originates from the Zebra's State of Auto Insurance record. The costs are for policies with 50/100/50 responsibility coverage restrictions and also a $500 insurance deductible for detailed and also crash insurance coverage.

According to the National Freeway Traffic Safety And Security Administration, 85-year-old men are 40 percent more most likely to get involved in a crash than 75-year-old men (insurers). Considering the table above, you can see that there is a direct connection between the collision price for an age which age's ordinary insurance policy costs.

Remember, you could discover far better prices via an additional firm that doesn't have a details student or elderly discount. * The Hartford is just offered to members of the American Organization of Retired Persons (AARP). Nevertheless, policyholders can add younger drivers to their plan and get price cuts. Ordinary Cars And Truck Insurance Fees As Well As Cheapest Supplier In Each State Due to the fact that vehicle insurance coverage rates vary so much from state to state, the service provider that supplies the most affordable automobile insurance coverage in one state might not use the least expensive insurance coverage in your state.

You'll likewise see the average price of insurance policy because state to help you compare. The table additionally consists of prices for Washington, D.C. These price estimates put on 35-year-old motorists with good driving documents as well as credit score. As you can see, ordinary vehicle insurance expenses differ widely by state. Idahoans pay the least for vehicle insurance, while vehicle drivers in Michigan spend the big bucks for coverage.

cheaper car insurance cheaper car insurance automobile perks

cheaper car insurance cheaper car insurance automobile perksIf you live in midtown Des Moines, your costs will most likely be greater than the state average. On the other hand, if you stay in upstate New york city, your automobile insurance coverage will likely cost less than the state standard. Within states, vehicle insurance costs can differ extensively city by city (car insurance).

The 3-Minute Rule for How Much Is Car Insurance Per Month? Average Cost

But, the state isn't one of the most expensive total (credit). Minimum Insurance coverage Needs A lot of states have economic duty regulations that require motorists to bring minimal cars and truck insurance policy coverage. You can just bypass coverage in two states Virginia as well as New Hampshire yet you are still financially liable for the damages that you trigger.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.